Table of Contents

1. Start Early:

One of the most valuable belongings in retirement making plans is time. The in advance you begin saving and making an funding for retirement, the extra time your cash has to extend via compound interest. Starting early permits you to make contributions smaller amounts over a extra prolonged period, probably resulting in huge financial financial savings by the point you retire.

2.Establish Clear Goals:

Define your retirement dreams by using thinking about the life-style you envision all through your golden years. Consider factors along with in which you need to live, the sports you want to pursue, and any journey plans. Having clear desires helps you decide the quantity of money you want to shop and the funding techniques that align along with your aspirations.

.

3. Build a Diverse Portfolio:

A properly-various funding portfolio can assist manage danger and optimize returns. Allocate your belongings throughout one-of-a-kind investment classes, which includes stocks, bonds, and real property, primarily based to your hazard tolerance and time horizon.Regularly overview and regulate your portfolio as needed to make sure it remains aligned in conjunction with your retirement desires and hazard tolerance.

4. Take Advantage of Employer-Sponsored Plans:

Many employers offer retirement economic financial savings plans, together with 401(ok)s or similar alternatives Contribute to these plans, specially in case your business enterprise offers an identical contribution

. Employer-subsidized plans provide tax advantages and may substantially enhance your retirement savings. Maximize your contributions to make the maximum of these advantages.

5. Understand Social Security Benefits:

Educate yourself approximately Social Security blessings and the gold standard time to start claiming them. While you could begin receiving advantages as early as age 62, delaying until your complete retirement age or past can result in higher month-to-month payments. Consider your health, economic needs, and other elements whilst selecting the timing of Social Security advantages.

6. Save Consistently:

Consistency is fundamental in retirement making plans. Set up automatic contributions to your retirement accounts, making sure a constant drift of finances into your financial savings. Treat your retirement financial savings as a non-negotiable cost, much like bills or mortgage bills. This approach facilitates build discipline and guarantees you consistently work in the direction of your monetary desires

7. Create an Emergency Fund:

Build and preserve an emergency fund separate out of your retirement savings. Having a economic cushion can assist cover surprising charges with out jeopardizing your long-term retirement plans. Aim to set apart three to 6 months’ worth of dwelling charges in a liquid and without difficulty accessible account.

8. Minimize Debt Before Retirement:

Entering retirement with full-size debt can pressure your price range. Strive to reduce excessive-interest debt, which includes credit cards or personal loans, before accomplishing retirement age. Paying down debt earlier can loose up greater sources for your retirement life-style and offer extra monetary peace of mind.

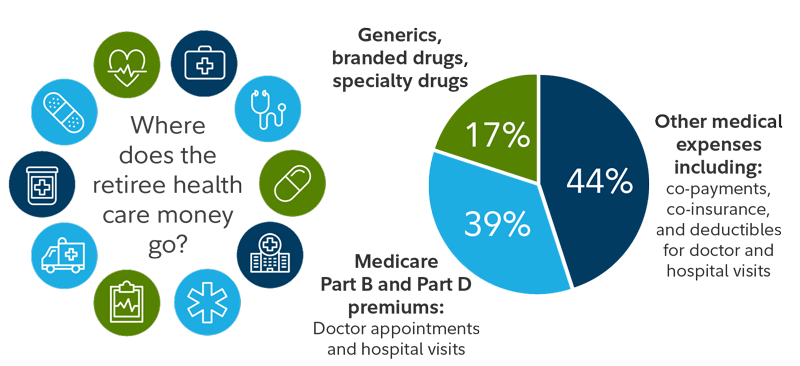

9. Consider Healthcare Costs:

Healthcare fees frequently boom with age, so it’s critical to element those prices into your retirement plan. Explore options such as long-term care coverage and Medicare to address potential healthcare wishes. Planning for healthcare fees guarantees that your retirement savings stay intact, even inside the face of unexpected clinical prices.

10. Reevaluate Expenses and Budget:

As you approach retirement, think again your cutting-edge and future fees. Create a practical finances that considers capacity changes in spending styles for the duration of retirement. Understanding your financial needs permits you to make informed decisions about life-style adjustments or capacity component-time paintings if vital.

11. Stay Informed About Tax Implications:

Understand the tax implications of your retirement accounts and funding techniques. Consult with a financial marketing consultant to optimize your tax state of affairs and take advantage of to be had tax breaks for retirees. Being proactive about tax making plans can help you maintain more of your retirement savings.

12. Plan for Longevity:

Increased lifestyles expectancy is a fantastic issue of our time, but it requires careful consideration in retirement planning. Plan for a retirement that would last several a long time, factoring in capacity increases in healthcare expenses and the want for sustainable income all through a longer retirement duration.

13. Stay Invested, Even in Retirement:

Once you retire, retain to manipulate your investments wisely. Maintaining a balanced and diversified portfolio can assist your money grow and provide ongoing monetary stability. Regularly review and alter your funding approach based for your changing needs and marketplace conditions.

14.Seek Professional Advice:

Consulting with a economic consultant can provide personalized guidance based totally for your precise financial situation and goals. An manual will allow you to navigate complicated economic picks, maximize your funding returns, and make certain that your retirement plan is aligned together along with your aspirations.

15.Stay Flexible and Adapt:

Life is unpredictable, and economic markets may be unstable. Stay flexible in your retirement planning and be prepared to evolve to converting situations

. Regularly reconsider your goals, funding method, and universal economic plan to make sure they continue to be in step with your evolving wishes and the monetary landscape.

16. Consider Downsizing and Lifestyle Adjustments:

As you method retirement, ponder whether downsizing your living arrangements makes sense to your monetary desires. Moving to a smaller domestic or a extra price-effective region can free up fairness and reduce ongoing charges. Additionally, don’t forget capability life-style modifications that align along with your price range while nonetheless allowing you to revel in a fulfilling retirement.

17. Explore Additional Income Streams:

Diversify your income streams by way of exploring opportunities for additional profits in retirement. This may want to include part-time paintings, consulting, freelancing, or monetizing a hobby or skill. Supplementing your retirement earnings can provide financial flexibility and make contributions to a more active and tasty retirement lifestyle.

18. Stay Health-Conscious:

Prioritize your fitness to mitigate ability healthcare fees in retirement. Regular workout, a balanced weight loss plan, and preventive healthcare measures can make contributions to a healthier, more energetic retirement. While you can’t manipulate all elements of your fitness, adopting a proactive method can positively effect your nicely-being and potentially lessen lengthy-term medical charges.

19. Plan for Inflation:

Inflation is a reality which could erode the shopping strength of your financial savings over time. Factor in inflation when estimating your destiny expenses and plan for capacity increases inside the cost of dwelling. Adjust your retirement savings goals for this reason to make sure that you hold your chosen trendy of living within the course of your retirement years.

20. Stay Engaged and Connected:

Retirement isn’t always pretty much monetary making plans; it’s also an opportunity to enrich your existence with new reviews and social connections. Stay engaged in activities that deliver you joy and fulfillment. Whether it’s turning into a member of clubs, volunteering, or pursuing lifelong passions, preserving a colourful social and emotional life can contribute notably for your prevalent nicely-being.

Conclusion:

Planning for retirement is a lifelong journey that requires determination, informed choice-making, and a dedication to economic nicely-being By beginning early, putting clean desires, diversifying your investments, and staying informed approximately applicable factors like Social Security and healthcare charges, you can lay the foundation for a steady and fun retirement. Remember, the golden years are an possibility to embody newfound freedom and pursue passions, and thoughtful retirement planning is the key to unlocking that capability.

For More Information Please Visit These Websites thisvid and gelbooru